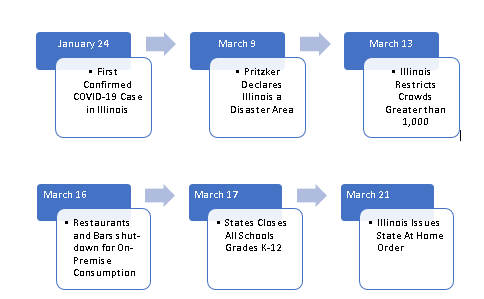

Since the first coronavirus case was announced in Illinois on January 24, 2020, Governor Pritzker and Mayor Lightfoot have taken a number of preventive measures in an effort to suppress the spread of the virus and ease the hardship on Illinois and Chicagoland residents. The following is a summary of recent local government assistance programs. An update on federal tax collection assistance for past due liabilities will be provided tomorrow.

Illinois Income Tax Filing and Payment Deadline Extended

Following the federal governments lead, on March 25, 2020, Governor Pritzker directed the Illinois Department of Revenue to extend the 2019 income tax filing and payment deadline for all taxpayers who file and pay Illinois income taxes to July 15, 2020.

Eligibility: All individuals, trusts, and corporations who file and pay Illinois income tax.

Procedure: Filing date is extended to July 15, 2020 automatically, taxpayers do not need to file any additional forms to qualify.

Penalties and Interest: Penalties and interest will begin to accrue on any unpaid balance beginning July 16, 2020.

Estimated Payments: First and second quarterly installments of estimated tax payments for 2020 are still due April 15 and June 15.

Sales and Use Tax Relief for Bars and Restaurants

On March 16, 2020, Governor Pritzker called on all businesses that offer food or beverages for on-premise consumption – such as restaurants, bars, grocery stores, and food halls – to suspend service of all on-premise consumption. In an effort to alleviate the financial impact to these businesses, the Illinois Department of Revenue is allowing any business operating an eating or drinking establishment that incurs a total sales tax liability of less than $75,000 during the 2019 calendar year to defer sales tax liabilities reported on Form ST-1 due during the February, March, and April 2020 reporting periods.

Filing Returns: Sales and Use Tax Returns must be timely filed during the relief period.

Payments: Total tax due for the February, March, and April 2020 reporting periods is required to be paid in a series of four payments. One quarter (1/4) of each month’s payment is due on May 20, June 22, July 20, and August 20, 2020.

Payment Calculation: Payments are calculated by dividing each month’s sales and use tax by four and adding the portion for each month, rather than calculating one-fourth of the aggregate amount due.

Penalties and Interest: In the event the Department assess penalties and interest for the deferred payments, taxpayers may respond to the assessment notice explaining that the taxpayer believed it should qualify for the relief.

Sunset: Beginning with the May 2020 reporting period (due June 22, 2020), all Sales & Use Tax must be timely filed and paid.

Unemployment Benefits Open to Workers Impacted by Coronavirus

The Illinois Department of Employment Security recently adopted emergency rules in response to the COVID-19 virus.

Employee Eligibility Under the Emergency Rules

- Under the emergency rules, employees who are temporarily laid off because of the COVID-19 virus may qualify for unemployment benefits if they are able and available to work at the time of the layoff.

- To be eligible for benefits, employees must be “actively seeking work.” Under the emergency rules, employees can meet this requirement if they are prepared to return to work as soon as the employer reopens.

- Employees confined to their homes because they have been diagnosed with COVID-19 virus, or caring for a parent, spouse or child that has been diagnosed, may be eligible for unemployment benefits. These employees must:

- Register with the state employment service;

- Be available to work; and

- Actively seek work from their home.

The employee will be considered available for work if there is some work that the employee can perform from home, and there is a labor market for that work.

- Under the emergency rules, Employees can apply for unemployment insurance as soon as they are laid off.

Employer Obligations

- When workers are laid off for a period of 7 days or more, or separate from the payroll for any reasons, employers are required to provide employees with a copy of an IDES publication which provides some basic information regarding unemployment benefits.

Chicago Small Business Resiliency Loan Fund

On March 19, 2020, Mayor Lightfoot announced the launch of a $100 million Chicago Small Business Resiliency Loan Fund. The fund will provide targeted, low-interest loans to severely impacted small businesses to provide relief for neighborhood entrepreneurs.

Eligibility

- Must have suffered at least a 25% drop in revenue attributable to COVID-19 virus;

- Have gross revenue of less than $3 million in 2019;

- Employ fewer than 50 personnel; and

- Have no pre-existing tax liens or legal judgments.

Terms

- Repayment: low-interest loans for up to 5 years

- Amount: Up to $50,000

- Loan Proceeds: Proceeds are required to be used for working capital. At least 50% of the proceeds must be applied toward payroll and commitment to retain the workforce by at least 50% of pre-COVID-19 levels.

Application: Administered through Community Development Financial Institution partners. Applications for proceeds may be submitted after March 31, 2020.

Concluding Remarks

Gensburg Calandriello & Kanter, P.C. is monitoring the situation on a daily basis. Please contact us with any questions or concerns you may have

Matthew Chodosh

[email protected]